TORONTO, ON (April 28, 2023) - EQ Inc. (TSXV: EQ) (“EQ Works” or the “Company”), a leader in geospatial data and artificial intelligence driven software, announced its financial results today for the fourth quarter and the year ended December 31, 2022.

EQ reported revenue of over $2.9 million for the quarter, which was an increase of 38% over the previous quarter and a decrease from the same quarter a year ago. The sequential revenue growth resulted primarily from an increase in the media division as advertisers increased their spending and continued to focus on partners who utilized the best data, sophisticated AI and the most robust technology solutions.

Revenue for the year ended December 31, 2022, was $11 million. Although this was a slight decrease from the previous year, the reduction was mainly due to changes in the media division. The Company has intentionally reduced its focus on media campaigns that did not utilize the full potential of EQ’s data and analytics offerings. As a result, these lower margin campaigns were discontinued during the quarter and although impacting top line revenue, they did not significantly impact our overall margin contribution. In turn, this change created additional bandwidth for the Company to refocus much of its resources towards its higher margin recurring revenue suite of products.

The Company’s mandate for 2023 is to become profitable and focus its sales efforts on its higher margin recurring revenue suite of products. As a result, during the later part of 2022 and into 2023, various cost cutting and restructuring changes were initiated to both headcount and operations. The annualized impact of the changes made to date has reduced the Company’s overall cost structure by approximately $3 million annually. Based on current forecasts, the Company expects to be profitable in the second half of 2023 and will continue to monitor its business outlook and make additional changes if required.

During the year, the Company also invested significantly into the building of Clear Lake (“CL”), a proprietaryconsumer insight platform, to generate a higher margin recurring revenue line of business. CL, one of the largest investments in the Company’s history, provides users with real-time access into one of Canada's largest and most comprehensive consumer purchasing panels. The data incorporates aggregated transactional spend data, geospatial insights on consumer location, other proprietary and exclusive data and the ability to execute against these data with recommended placement opportunities. CL allows users to analyze data that enables them to:

understand their customers better;

improve insights into their competition;

optimize marketing and communication channels;

activate media using the most effective segments; and

improve overall business strategy and decision making.

CL was officially launched in 2023 and has generated significant market interest. Early indications are very encouraging and the Company has seen traction and interest from clients across multiple verticals. The expenses related to this build were all expensed in 2022 and as a result, the adjusted EBITDA loss for the year was approximately $5.3 million, an increase compared to 2021 however, aligned with our investment strategy.

Highlights for the Fourth Quarter and Year ended December 31, 2022

Increased quarterly revenue by 38% sequentially;

Awarded an extension for a multi-year engagement with a leading Canadian University valued at up to $5.5 Million;

Extended a contract with a budget increase of $400,000 from a major Canadian financial institution was awarded during the quarter;

Completed our new consumer insights platform, Clear Lake;

Renewed multi-year partnership with one of Canada’s largest Diversified Media Companies valued at up to $6 Million; and

Initiated various cost efficiency measures expected to drive annual savings of $3M.

“Our focus during the year was to continue evolving our data offering, generate licensing solutions for recurring revenue, and properly align our cost structure. With new data partnerships being contracted, CL being completed, and various cost efficiencies initiated, we believe that all of these were addressed in 2022, and we expect to see the full results of these initiatives as the year progresses” said Geoffrey Rotstein, President and CEO of EQ Works. “While 2022 was a difficult year within certain verticals that we operate, we are pleased with our progress and how our team and technology have adapted to these changes. We identified challenges early and modified our approach to secure our position as a trusted partner for our most valued clients.”

Non-IFRS Financial Measures

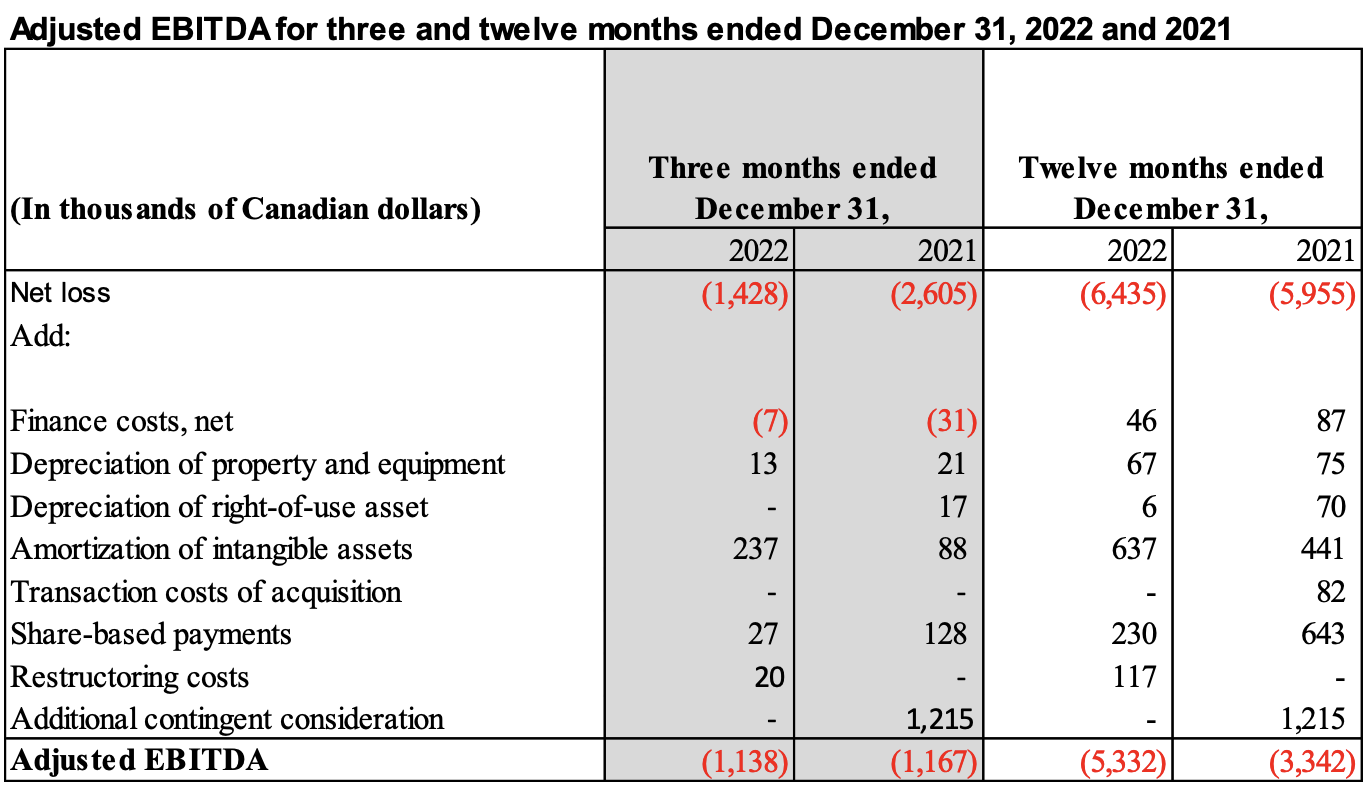

EQ Works measures the success of the Company’s strategies and performance based on Adjusted EBITDA, which is outlined and reconciled with net income (loss) in the section entitled “Reconciliation of Net Loss for the period to Adjusted EBITDA” in the MD&A. The Company defines Adjusted EBITDA as net income (loss) from operations before: (a) depreciation of property and equipment and amortization of intangible assets, (b) share-based payments, (c) finance income and costs, net, (d) depreciation of right-of-use assets (e) additional contingent consideration (f) transaction costs of acquisition (g) Restructuring costs. Management uses Adjusted EBITDA as a measure of the Company's operating performance because it provides information on the Company's ability to provide operating cash flows for working capital requirements, capital expenditures, and potential acquisitions. The Company also believes that analysts and investors use Adjusted EBITDA as a supplemental measure to evaluate the overall operating performance of companies in its industry.

The non-IFRS financial measure is used in addition to, and in conjunction with, results presented in the Company’s consolidated financial statements prepared in accordance with IFRS and should not be relied upon to the exclusion of IFRS financial measures. Management strongly encourages investors to review the Company's consolidated financial statements in their entirety and to not rely on any single financial measure. Because non-IFRS financial measures are not standardized, it may not be possible to compare these financial measures with other companies non-IFRS financial measures having the same or similar names. In addition, the Company expects to continue to incur expenses similar to the non-IFRS adjustments described above, and exclusion of these items from the Company's non-IFRS measures should not be construed as an inference that these costs are unusual, infrequent, or non-recurring.

The table below reconciles net loss from operations and Adjusted EBITDA for the periods presented:

About EQ Works

EQ Works (www.eqworks.com) enables businesses to understand, predict, and influence customer behaviour. Using unique data sets, advanced analytics, machine learning and artificial intelligence, EQ Works creates actionable intelligence for businesses to attract, retain, and grow the customers that matter most. The Company’s proprietary SaaS platform mines insights from movement and geospatial data, enabling businesses to close the loop between digital and real-world consumer actions.

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

Certain statements contained in this press release constitute “forward-looking statements”. All statements other than statements of historical fact contained in this press release, including, without limitation, those regarding the Company’s future financial position and results of operations, strategy, plans, objectives, goals and targets, and any statements preceded by, followed by or that include the words “believe”, “expect”, “aim”, “intend”, “plan”, “continue”, “will”, “may”, “would”, “anticipate”, “estimate”, “forecast”, “predict”, “project”, “seek”, “should” or similar expressions, or the negative thereof, are forward-looking statements. These statements are not historical facts but instead represent only the Company’s expectations, estimates, and projections regarding future events. These statements are not guarantees of future performance and involve assumptions, risks, and uncertainties that are difficult to predict. Therefore, actual results may differ materially from what is expressed, implied, or forecasted in such forward-looking statements. Additional factors that could cause actual results, performance, or achievements to differ materially include, but are not limited to, the risk factors discussed in the Company’s MD&A for the year ended December 31, 2022. Management provides forward-looking statements because it believes they provide useful information to investors when considering their investment objectives but cautions investors not to place undue reliance on forward-looking information. Consequently, all of the forward-looking statements made in this press release are qualified by these cautionary statements and any other cautionary statements or factors contained herein, and there can be no assurance that the actual results or developments will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, the Company. These forward-looking statements are made as of the date of this press release, and the Company assumes no obligation to update or revise them to reflect subsequent information, events, or circumstances or otherwise, except as required by law.

EQ Inc. • Peter Kanniah, Chief Financial Officer •1235 Bay Street, Suite 401 | Toronto, Ontario | M5R 3K4 • press@eqworks.com