TORONTO, ON (November 18, 2022) - EQ Inc. (TSXV: EQ) (“EQ Works” or the “Company”), a leader in geospatial data and artificial intelligence driven software, announced its financial results today for the third quarter ending September 30, 2022.

EQ’s revenue for the third quarter of over $2.1 million, was a decrease from the same quarter a year ago. Data revenue, as a percentage of total revenue, increased to 33% for the quarter showing once again the value and importance that clients place in data assets and solutions that provide value to their business. The overall decrease in revenue resulted primarily from reductions in the media division as certain campaigns were delayed and the Company refocused much of its resources towards its higher margin recurring revenue suite of products.

During the third quarter, and continuing into the fourth quarter, various cost cutting and restructuring changes were initiated to both headcount and operations. With a focus on profitability and higher margin recurring revenue products, these changes have reduced the Company’s overall cost structure by approximately $2.5 million annually. Based on current forecasts, the Company expects to be profitable in the second half of 2023 and will continue to monitor its business outlook and make additional changes if required.

Highlights for the Third Quarter ended September 30, 2022

Fourth quarter bookings forecast to be approximately 50% higher than what was realized in the third quarter;

Contract extension and budget increase of $400,000 from a major Canadian financial institution was awarded during the quarter;

Contract extension and budget increase of $600,000 from a leading Canadian university was awarded during the quarter;

8 new clients were signed during the quarter for data and media engagements with delivery scheduled for the fourth quarter of 2022 and into 2023;

Data revenue increased to 33% of total revenue for the quarter;

Initial release of the new retail insights product (“ClearLake”) with a number of beta customers already using the system including 2 of Canada’s largest companies;

3 new data partnerships integrated into EQ’s data portfolio to further enhance capabilities in its core verticals; and

Subsequent to the quarter end, the company renewed its engagement with one of Canada’s largest diversified media companies, which historically has accounted for over $6 million in revenue for a 36 month term.

Media revenue for the quarter was impacted primarily by reduced spending in the automotive sector, with certain budgets being pushed out to later in the year. The Company believes much of this revenue will materialize in future quarters and to date, the Company has fourth quarter bookings that are already approximately 50% higher than the previous quarter, in addition to the continued momentum in its recurring revenue products.

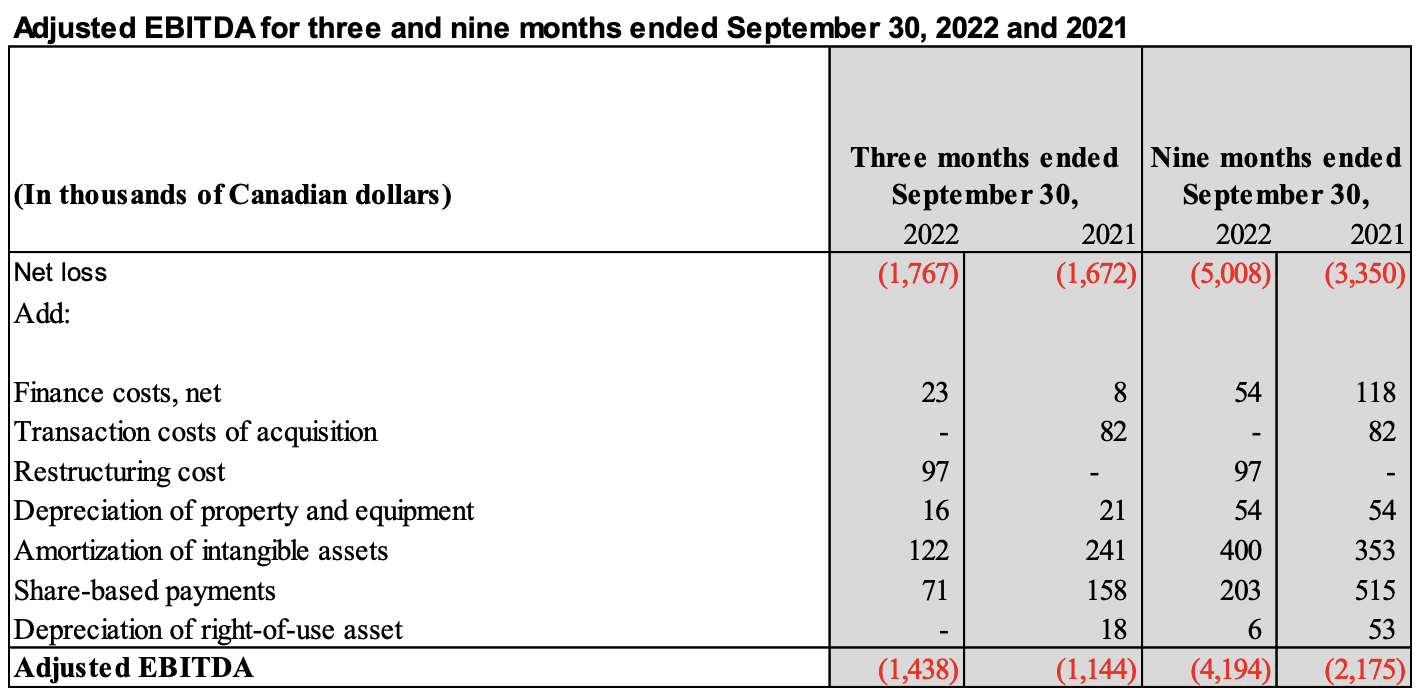

The Company continued to focus its investments during the quarter into its recurring revenue suite of products. Those investments, combined with the reduced media revenue, resulted in an adjusted EBITDA loss for the quarter of approximately $1.4 million. With these investments now substantially complete and products currently in market, the Company is focused on profitability. Sales and marketing efforts to grow its recurring revenue will continue as the Company rolls out its insights and data products for both the retail and automotive verticals. Each of these verticals account for hundreds of millions of dollars of spend annually for data, analytics and media. EQ’s investments in unique and proprietary data, that adhere to privacy and compliance protocols, complemented with solutions that make data actionable, are significant differentiators and position the Company extremely well to address these markets.

“We are confident with the investments we have made and by focusing on the future and listening to our clients, we have solutions in market that continue to be in demand and address the challenges of the current data and privacy landscape” said Geoffrey Rotstein, CEO of EQ Works. “While we are by no means satisfied with our results this quarter, we are already seeing momentum return and some of the delayed campaigns from previous quarters are already back in market. Our product releases are being met with enormous interest and position us well to grow our monthly recurring revenue, enhance profitability, help mitigate quarterly fluctuations in revenue, and forecast stronger financial results in the quarters to come.”

As part of the renewed focus on products, recurring revenue, and changes to the team, the Company also announced that Dilshan Kathriarachchi will be leaving the organization. Dilshan has had a tremendous impact on EQ and has been a key contributor to our success to date and the Company wishes him the best with his future opportunities.

Non-IFRS Financial Measures

EQ Works measures the success of the Company’s strategies and performance based on Adjusted EBITDA, which is outlined and reconciled with net income (loss) in the section entitled “Reconciliation of Net Loss for the period to Adjusted EBITDA” in the MD&A. The Company defines Adjusted EBITDA as net income (loss) from operations before: (a) depreciation of property and equipment and amortization of intangible assets, (b) share-based payments, (c) finance income and costs, net (d) depreciation of right-of-use assets (e) restructuring cost (f) transaction costs of acquisition. Management uses Adjusted EBITDA as a measure of the Company's operating performance because it provides information on the Company's ability to provide operating cash flows for working capital requirements, capital expenditures, and potential acquisitions. The Company also believes that analysts and investors use Adjusted EBITDA as a supplemental measure to evaluate the overall operating performance of companies in its industry.

The non-IFRS financial measure is used in addition to, and in conjunction with, results presented in the Company’s consolidated financial statements prepared in accordance with IFRS and should not be relied upon to the exclusion of IFRS financial measures. Management strongly encourages investors to review the Company's consolidated financial statements in their entirety and not rely on any single financial measure. Because non-IFRS financial measures are not standardized, it may not be possible to compare these financial measures with other companies' non-IFRS financial measures having the same or similar names. In addition, the Company expects to continue to incur expenses similar to the non-IFRS adjustments described above, and exclusion of these items from the Company's non-IFRS measures should not be construed as an inference that these costs are unusual, infrequent, or non-recurring.

The table below reconciles net loss from operations and Adjusted EBITDA for the periods presented:

About EQ Works

EQ Works (www.eqworks.com) enables businesses to understand, predict, and influence customer behaviour. Using unique data sets, advanced analytics, machine learning, and artificial intelligence, EQ Works creates actionable intelligence for businesses to attract, retain, and grow the customers that matter most. The Company’s proprietary SaaS platform mines insights from movement and geospatial data, thereby enabling businesses to close the loop between digital and real-world consumer actions.

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

Certain statements contained in this press release constitute “forward-looking statements”. All statements other than statements of historical fact contained in this press release, including, without limitation, those regarding the Company’s future financial position and results of operations, strategy, plans, objectives, goals and targets, and any statements preceded by, followed by or that include the words “believe”, “expect”, “aim”, “intend”, “plan”, “continue”, “will”, “may”, “would”, “anticipate”, “estimate”, “forecast”, “predict”, “project”, “seek”, “should” or similar expressions, or the negative thereof, are forward-looking statements. These statements are not historical facts but instead represent only the Company’s expectations, estimates, and projections regarding future events. These statements are not guarantees of future performance and involve assumptions, risks, and uncertainties that are difficult to predict. Therefore, actual results may differ materially from what is expressed, implied, or forecasted in such forward-looking statements. Additional factors that could cause actual results, performance, or achievements to differ materially include, but are not limited to, the risk factors discussed in the Company’s MD&A for the quarter ended September 30, 2022. Management provides forward-looking statements because it believes they provide useful information to investors when considering their investment objectives but cautions investors not to place undue reliance on forward-looking information. Consequently, all of the forward-looking statements made in this press release are qualified by these cautionary statements and any other cautionary statements or factors contained herein, and there can be no assurance that the actual results or developments will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, the Company. These forward-looking statements are made as of the date of this press release, and the Company assumes no obligation to update or revise them to reflect subsequent information, events, or circumstances or otherwise, except as required by law.

EQ Inc. • Peter Kanniah, Chief Financial Officer • press@eqworks.com