TORONTO, ON (November 18, 2020) - EQ Inc. (TSXV: EQ) (“EQ Works” or the “Company”), a leader in geospatial data and intelligence, announced its financial results today for the third quarter ended September 30, 2020.

Revenue for the third quarter was approximately $2.9 million, which increased over 65% from the previous quarter and increased by 15% when compared to the third quarter of 2019. This revenue growth was the result of new data engagements entered into during the quarter and the overall continued growth in the business. Gross margin for the quarter was 50%, significantly stronger than the previous quarter and up substantially from the same period a year ago. Adjusted EBITDA loss for the quarter was approximately $0.1 million, a significant improvement from the loss of $0.6 million experienced in the previous quarter.

The Company continued to show growth from both its data and advertising divisions. A continued focus on driving business results from data and analytics, artificial intelligence, predictive modelling and machine learning has continued to generate interest and demand for the Company’s products. Data revenue for the quarter increased by 81% compared to the same period a year ago and 64% sequentially, as demand continued to increase for the proprietary data solutions.

Business conditions continued to improve throughout the quarter, as clients reinvested in their business and engaged with the Company.

Highlights for the Third Quarter ended September 30, 2020

Data revenue increased by 81% compared to the same period last year and 64% sequentially;

Gross margin increased to 50% for the three months ended September 30, 2020 compared to 42% for the same period in 2019 and 37% sequentially;

Cash balance at the end of the quarter was $4.7 million and net working capital was $3 million;

Operating line of credit with one of Canada’s major banks was increased to $1.6 million;

Extension was awarded to EQ for a multi-year engagement with a leading Canadian university;

U.S. expansion with one of the world’s largest book publishers to help launch 10 new titles nationally across the United States; and

33 new clients during the first nine months of the year.

"I am extremely proud of how well our team performed during the quarter and excited to see the continued momentum as we push into the fourth quarter” said Geoffrey Rotstein, President and CEO of EQ Works. “Our performance this quarter was the direct result of our team working with our clients to make sure our products delivered the business results they needed. Understanding and engaging with customers has never been more important and our proprietary data platform provides these insights.”

Subsequent to quarter-end, The Company granted 165,000 stock options to directors and employees of the Company. These stock options are exercisable at CDN $ 1.35 per stock option and will expire on November 15, 2025. These stock options vest over a period of thirty-six months following the grant date and are governed by the terms and conditions of the Company's stock options plan. Following this grant of stock options, the Company has a total of 4,273,667 stock options outstanding representing approximately 7.3% of the outstanding common shares of the Company.

Non-IFRS Financial Measures

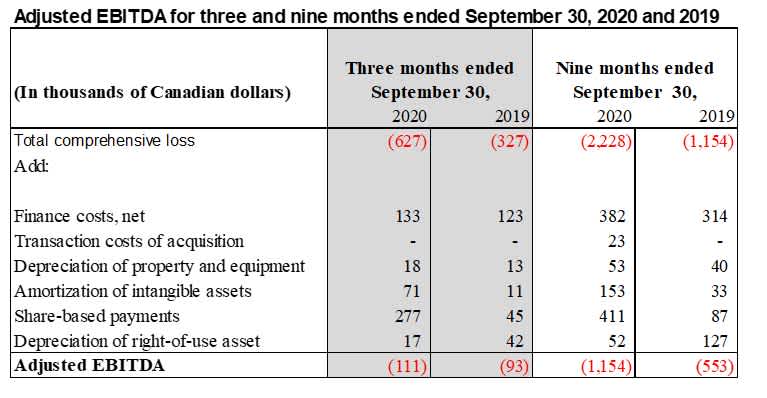

EQ Works measures the success of the Company’s strategies and performance based on Adjusted EBITDA, which is outlined and reconciled with net income (loss) in the section entitled “Reconciliation of Net Loss for the period to Adjusted EBITDA” in the MD&A. The Company defines Adjusted EBITDA as net income (loss) from operations before: (a) depreciation of property and equipment and amortization of intangible assets, (b) share-based payments, (c) finance income and costs, net, (d) depreciation of right-of-use assets, and (e) transaction costs of acquisition. Management uses Adjusted EBITDA as a measure of the Company's operating performance because it provides information on the Company's ability to provide operating cash flows for working capital requirements, capital expenditures, and potential acquisitions. The Company also believes that analysts and investors use Adjusted EBITDA as a supplemental measure to evaluate the overall operating performance of companies in its industry.

The non-IFRS financial measure is used in addition to, and in conjunction with, results presented in the Company’s consolidated financial statements prepared in accordance with IFRS and should not be relied upon to the exclusion of IFRS financial measures. Management strongly encourages investors to review the Company's consolidated financial statements in their entirety and to not rely on any single financial measure. Because non-IFRS financial measures are not standardized, it may not be possible to compare these financial measures with other companies' non-IFRS financial measures having the same or similar names. In addition, the Company expects to continue to incur expenses similar to the non-IFRS adjustments described above, and exclusion of these items from the Company's non-IFRS measures should not be construed as an inference that these costs are unusual, infrequent, or non-recurring.

The table below reconciles net loss from operations and Adjusted EBITDA for the periods presented:

About EQ Works

EQ Works (www.eqworks.com) enables businesses to understand, predict, and influence customer behaviour. Using unique data sets, advanced analytics, machine learning and artificial intelligence, EQ Works creates actionable intelligence for businesses to attract, retain, and grow the customers that matter most. The Company’s proprietary SaaS platform mines insights from movement and geospatial data, enabling businesses to close the loop between digital and real-world consumer actions.

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

Certain statements contained in this press release constitute “forward-looking statements”. All statements other than statements of historical fact contained in this press release, including, without limitation, those regarding the Company’s ability to adjust to customer needs in light of COVID-19, the delivery of acceleration notices to the holders of Warrants and the exercise of the Warrants by holders, future financial position and results of operations, strategy, plans, objectives, goals and targets, and any statements preceded by, followed by or that include the words “believe”, “expect”, “aim”, “intend”, “plan”, “continue”, “will”, “may”, “would”, “anticipate”, “estimate”, “forecast”, “predict”, “project”, “seek”, “should” or similar expressions, or the negative thereof, are forward-looking statements. These statements are not historical facts but instead represent only the Company’s expectations, estimates, and projections regarding future events. These statements are not guarantees of future performance and involve assumptions, risks, and uncertainties that are difficult to predict. Therefore, actual results may differ materially from what is expressed, implied, or forecasted in such forward-looking statements. Additional factors that could cause actual results, performance, or achievements to differ materially include, but are not limited to, the risk factors discussed in the Company’s MD&A for the three and nine months ended September 30, 2020. Management provides forward-looking statements because it believes they provide useful information to investors when considering their investment objectives but cautions investors not to place undue reliance on forward-looking information. Consequently, all of the forward-looking statements made in this press release are qualified by these cautionary statements and any other cautionary statements or factors contained herein, and there can be no assurance that the actual results or developments will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, the Company. These forward-looking statements are made as of the date of this press release, and the Company assumes no obligation to update or revise them to reflect subsequent information, events, or circumstances or otherwise, except as required by law.

EQ Inc.

Peter Kanniah, Chief Financial Officer

416-260-4326